Regions Mobile Deposit

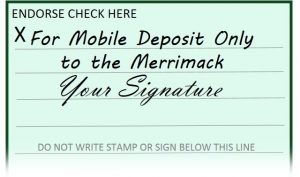

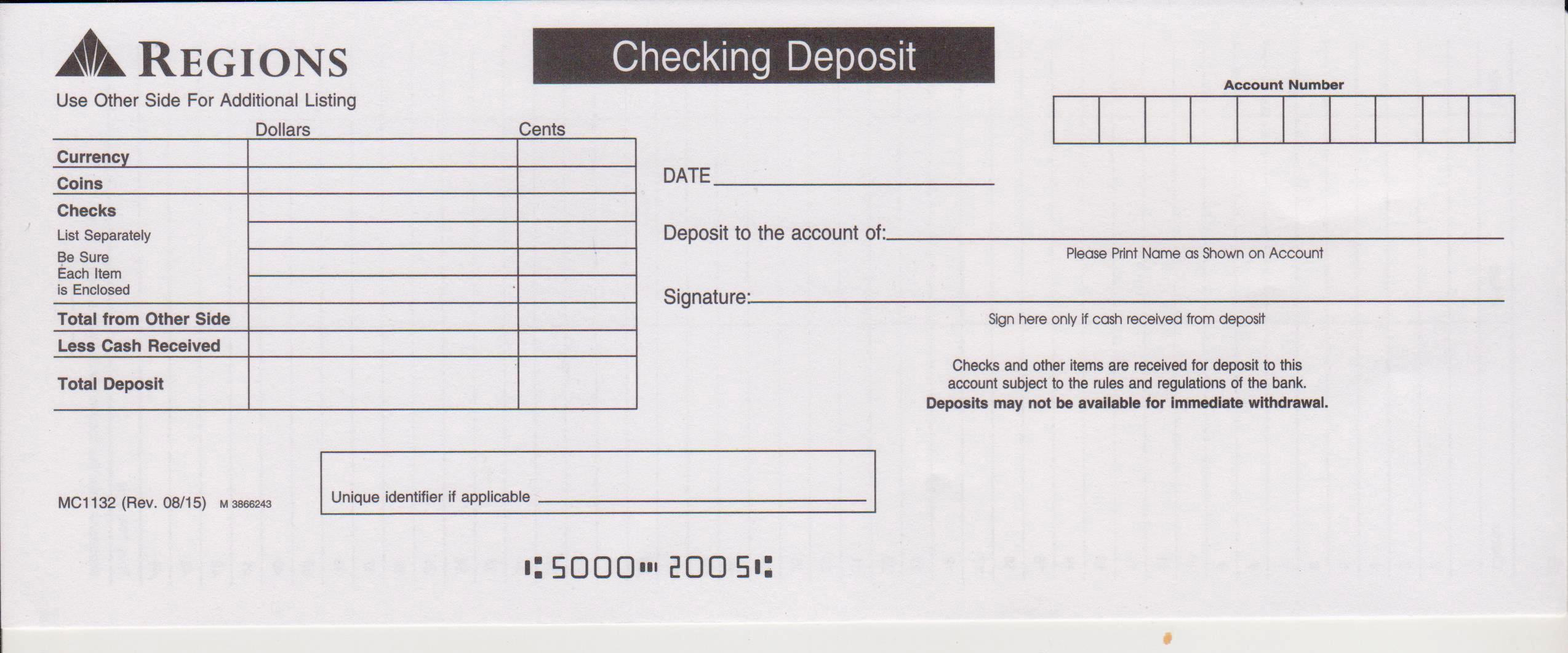

Regions Quick Deposit Mobile Xpress Use your mobile device to make check deposits on the fly. With Regions Quick Deposit Mobile Xpress, you can deposit a check as soon as your client gives it to you, plus get quick access to simple reporting and deposit details. Regions Quick Deposit Mobile 1. Regions Quick Deposit® Mobile enables Regions business clients to capture check images to make deposits without ever having to travel to a Regions branch or back to their office. Leveraging their mobile device, users can easily deposit checks on the go. As with all of the Regions Quick Deposit offer.

Regions Bank has 1,500 branches in 15 states in the South and Midwest. Checking and savings accounts require just $50 to open, with relatively lower requirements to waive fees.

Regions Mobile App Mobile Banking, Alerts, Notifications, Text Banking and Mobile Deposit require a compatible device and enrollment in Online Banking. All are subject to separate terms and conditions. Regions Mobile Deposit TV Commercial, 'Helping You Give Life the Green Light' Ad ID: 1104985 30s 2014 ( Inactive ). Regions Quick Deposit® Mobile enables Regions business clients to capture check images to make deposits without ever having to travel to a Regions branch or back to their office. Leveraging their.

Regions Bank Promotions

Regions Bank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

All Regions Bank checking accounts offer free online banking, bill pay, and mobile deposits. There are 2,200 ATMS across 16 states.

Special Checking Account Features

Regions checking accounts come with these special features:

- Relationship Rewards. Earn relationship reward points when you do normal banking activities, like using online bill pay, making ATM deposits, etc. You can then redeem rewards for cash, gift cards, travel, and more.

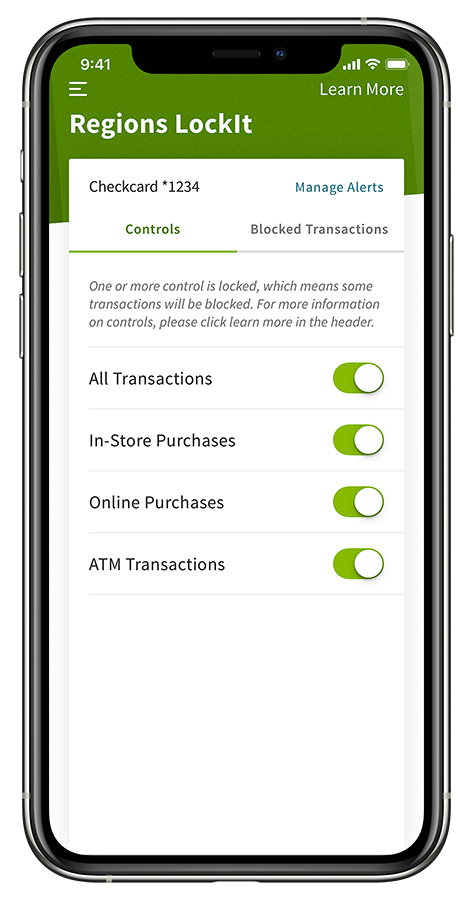

- Regions LockIt. This allows you to block transactions. For example, if you want to control your spending while out for a day, you can lock in-store purchases so you're not tempted. If you lose your card, you can lock all transactions until you find it or report it as lost. You can control this straight on the mobile app.

- Overdraft protection. To help cover overdrafts, you can link your Regions checking account to a savings, money market account, Regions credit card, or Regions personal line of credit. Note: Transfer fees may apply. You must opt in to this service.

What to Open at Regions Bank

- Promotional CDs. If you have at least $10,000 to save, Regions Bank offers a promotional CD with highly competitive rates. You can choose terms of 12-15 months. You must also own a Regions checking account to receive this relationship rate.

- Regions LifeGreen Savings. If you have a Regions checking account, you can open this savings account with no monthly service fee. Opening deposit is $50 if opened online or $5 at a bank. If you set up automated monthly transfers from your checking into this savings, you will earn a 1% annual savings bonus (up to $100/year).

- Now Banking and Cash Solutions. This allows you to manage your money without a Regions checking account. You get a prepaid Visa for purchases. You also get a savings account with no monthly fee and opportunities for savings bonuses. It also offers check cashing services (for a small percentage of the check amount) with immediate access to your funds.

- Student Checking. This account has no monthly service fee and no minimum balance requirements for customers under 25.

How to Avoid Regions Bank Checking Account Fees

Regions Mobile Deposit Money Order

Regions Mobile Deposit Limit

- LifeGreen Simple Checking. This account has no minimum balance requirements, but the monthly fee cannot be waived.

- LifeGreen Checking. The $8 monthly fee (with e-statements) can be waived if you: maintain a monthly average balance of $1,500, OR have at least a single recurring direct deposit of $500, OR have combined deposits of at least $1,000.

- LifeGreen eAccess. The $8 monthly fee (with e-statements) can be waived if you make at least 10 Regions debit card and/or credit card purchases per cycle.

- LifeGreen Preferred Checking. The $18 monthly fee can be waived if you: maintain a monthly average balance of $5,000, OR maintain a combined balance of at least $25,000 across all Regions deposit accounts, OR have a qualifying first-lien home mortgage loan, OR have a combined loan balance of at least $25,000 across all Regions loans, lines of credit, and credit cards.

- Life Green Student Checking. This account has no monthly service fee and no minimum balance requirements if you are under 25.

- LifeGreen 62+ Checking. The $8 monthly fee (with e-statements) can be waived if you: maintain a monthly average balance of $1,500, OR have at least a single recurring direct deposit of $300, OR have combined deposits of at least $1,000.