Safety Deposit Box Cost

- Cash In Safety Deposit Box Rules

- Safety Deposit Boxes At Banks

- Safety Deposit Box Cost A Month

- Safety Deposit Box Cost Rbc

- Regions Safety Deposit Box Cost

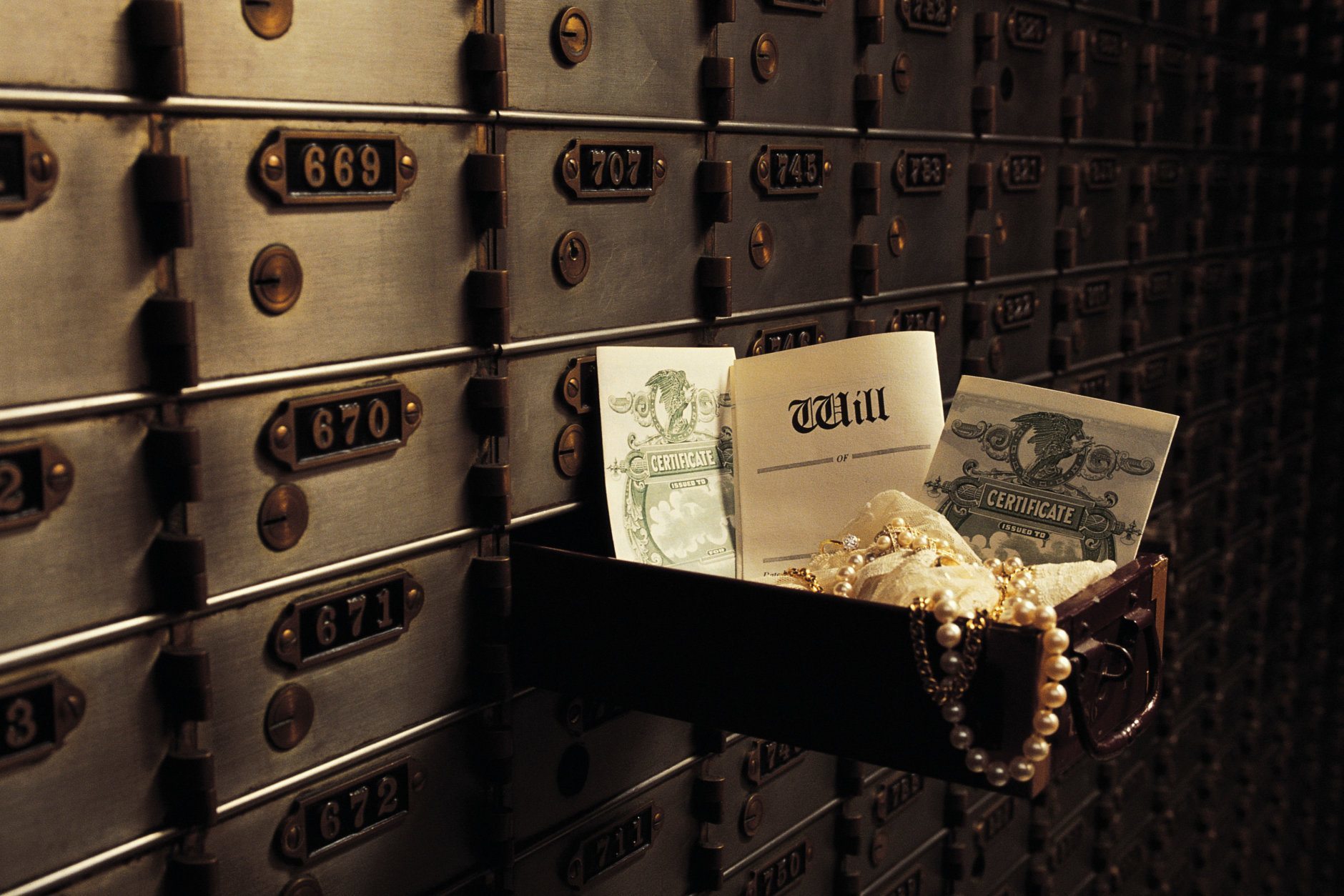

A safety deposit box, also known as a safe deposit box, is an individually locked box held within a larger vault, usually in a bank. The boxes come in a range of sizes and can be rented on an annual basis. People use them to store valuables, documents and other valuable items they want to be kept safe. Read on for more information on how much they cost, where you can rent one and why you might need one.

We researched the costs of safe deposit boxes from branches at the top 20 U.S. Banks and found that they can be as small a 1-inch by 5-inches to as large as 10-inches by 24-inches. The Average Cost of a Safety Deposit Box by Chris Moon updated December 21, 2020 The average cost of a safety deposit box changes according to the size of the box and the location of the bank where it is stored. On average, the banks we surveyed charge about $60 annually for their smallest boxes, which are usually 3'x5'x24'.

Are Safety Deposit Boxes Secure?

In terms of access, safety deposit boxes are very secure. Typically, each comes with two keys needed to open the box: one held by the bank and the other held by you, the box’s owner. When you go into the bank to access a safety deposit box, banks require identification. If someone else needs to access your box, they will need prior authorization from you. For extra security, don’t put any identifying information on your safe deposit box key, like the box number or bank’s name. This way, if you lose your key or someone steals it, no one will know what it belongs to.

Safety deposit boxes are housed in vaults with thick doors and walls, reinforced to keep them safe during hurricanes, tornadoes and other natural disasters. However, no space is entirely safe from natural disasters. You may want to place your items in waterproof containers to prevent water damage.

This might not sound any better than placing items in a safe at your own home. However, a thief can more easily break into your home and home safe than into a bank vault and deposit box. In case of a home robbery, robbers could force you to open your home safe or take the safe and open it by other means. Even if robbers broke into a bank’s vault, they could not open your deposit box without your key.

Storing items in a safe deposit box does offer a safe physical space for your valuables. However, in the event that they are somehow stolen, they may be less protected. Neither the bank nor the FDIC insure the contents of safety deposit boxes. Banks will not reimburse you for theft or damage, either. If you want to insure your items, you’ll need to get that coverage yourself. You can find a property insurance agency, a safety deposit box-specific agency or add a special policy to your homeowners insurance.

What Should You Store in a Safety Deposit Box?

Due to their secure nature, safe deposit boxes are an ideal place to store valuables and important documents. People typically store personal and property files, including original birth certificates, insurance policies, property deeds, car titles and U.S. bonds. You can also store items like gold coins, family heirlooms and photo negatives. Again, you may want to place paper items in waterproof containers for extra protection.

You shouldn’t use a safety deposit box to store passports, revocable living wills and powers of attorney. These are documents that need to be reached without jumping through too many hoops. You also should avoid storing cash in your safe deposit box. Not only is it against the rules of many banks, it’s also safer in an FDIC-insured bank account. Plus, stashing cash in a high-yield savings account can grow your money rather than let it sit idly.

How much is a safe deposit box at the post office. The price of Post office boxes depend on the size. You can choose a post office box that suits the amount of mail you receive:.Small box: 90mm x 130mm, ideal for personal mail.Medium box: 135mm x 130mm, suits most small to medium businesses.

Do not use safety deposit boxes to store any items you might need quickly, especially in an emergency. You can only access your safety deposit box during the bank’s business hours. If an emergency comes up in the middle of the night and you need something from your safety deposit box, you won’t be able to access it until the morning.

It’s important to remember that no one can get into your safety deposit box unless you have pre-authorized them. Therefore, you may not want to store anything like medical directives or funeral arrangements. In those cases, you may not have time to pre-authorize anyone to access those documents. If you absolutely want to place these documents in a safety deposit box, you may want to authorize a trusted partner to access your safe deposit box in case of an emergency. That can minimize the risk of losing the box’s contents.

How Much Do Safety Deposit Boxes Cost to Rent?

The cost to rent a safety deposit box depends on the size of the box and location of your bank, ranging from about $20 for a small box to $200 for a large one. A small box is typically 3 inches by 5 inches, the size of an index card, and a foot long. Safe deposit boxes come in a range of sizes up from there, with the largest being 10 inches by 10 inches and two feet deep.

Wells Fargo’s safe-deposit-box contract caps the bank’s liability at $500. Citigroup limits it to 500 times the box’s annual rent, while JPMorgan Chase has a $25,000 ceiling on its liability. Safe Deposit Box rentals range from $60 to $500 annually plus applicable taxes. However, depending on your banking account, this service may be available to you at no additional charge or at a discount.

Prices not only differ between banks but can also vary by bank location. You should call your local bank branch to find out the annual rental costs for their safety deposit boxes. If you have a checking account, it may include a free or discounted box in its perks. If you don’t pay your rent for the box, the bank will seize the contents, so be sure to pay.

The table below has common rent prices for a safety deposit box at six major banks. Again, actual prices and availability will vary by bank and by location.

| Average Safety Deposit Box Prices | |||||

| Box Size (inches): | 3×5 | 5×5 | 3×10 | 5×10 | 10×10 |

| Bank of America | $77 | $104 | – | $152 | $192 |

| Chase | $83 | – | $140 | $220 | $350 |

| Wells Fargo | $60 | – | $55 | $100 | – |

| PNC | $40 | – | – | – | $110 |

| TD Bank | $58 | $90 | $130 | $158 | $275 |

| BB&T | $40 | $50 | $55 | $70 | $115 |

Where Can I Rent a Safety Deposit Box?

The safest place to rent a safety deposit box is a bank where you have an account. Banks specialize in storing money and they typically have dedicated, secured vaults for safety deposit boxes. If you want to rent a safety deposit box, call or visit your local bank branch. Often, there are waiting lists for safety deposit boxes. This means you may not get a box at the same time you go to open one. You may even decide to shop around to find a bank with available space.

If you just need to store copies of important documents and information, you can also try a virtual safety deposit box. Fidelity is one company that offers this service, providing free encrypted storage space to users. This is a convenient way to keep copies of files like birth certificates, passports, property deeds and more. An added benefit is the ability to access the files from any computer in the world, in case of emergency while traveling.

Bottom Line

Safety deposit boxes offer a secure place to store your most valuable items. Banks and their heavily protected vaults are designed to protect its contents safe from theft and natural disasters. However, it’s not ideal for all valuable items, like passports or your will. You’ll still want to keep these items safe, of course, just more accessible than in a safety deposit box. If you’re thinking about opening a safety deposit box with your bank, you should call sooner rather than later since there may be a wait list.

Tips for Safe Banking

- No matter where you bank, your money and information are at risk of being stolen and used by fraudsters. Monitor your checking and savings accounts periodically and check your bank statements carefully to ensure you have authorized each transaction.

- If you’re ever transferring money electronically, you’ll want to make sure you know exactly who you’re sending it to. This is especially true for transactions like wire transfers, where it’s crucial you have all the correct information.

Photo credit: ©iStock.com/simonkr, ©iStock.com/kali9, ©iStock.com/Tashi-Delek

If you have some valuable items you don’t want to keep at home, such as collectibles or jewelry, you may find that you want to head to your local bank to get a safety deposit box.

How much do safe deposit boxes cost?

The cost will depend on the size and the bank you choose. A small box can cost $15 to $30 per year, while a medium box, which measures 4 by 10 inches will cost $40 to $60 per year. A larger box can cost upwards of $180 to $500 per year.

According to CBS Money Watch, the average safe deposit box costs anywhere from $30 to as much as $75 a year. Mint.com backs up these numbers as well.

Bank of America charges $30 for a 2×5, $100 for a 10×10, and $190 a year for a 17×15.

Chase Bank has over 60 different sizes to choose from. For example, a 2×5 can run $65 annually.

Citibank has many various sizes as well. Here, a 2×5 is $20 a year and a 24×48 is as much as $3,318 a year.

Wells Fargo also has different sizes. The 2×5 is $40 a year and the 10×10 is $120 a year.

If you want to purchase one for your home, the SentrySafe H2300 ranges anywhere from $40 to $60, and the Digital Safe Box by Solar Eclipse can cost anywhere from $30 to $50.

| Bank | Price (per year) |

|---|---|

| Bank of America | $18 for 3x6x6 or $75 for 3x5 |

| Chase Bank | $45 for 3x5 (free for qualifying customers) |

| Citibank | $65 for 3x5 |

| Fifth Third Bank | $275 for 10x10 |

| PNC Bank | $100 ($10 discount to qualifying customers) |

| Regions Bank | $125 for 5x10 (30% discount for qualifying customers and 10% for auto debit) |

| U.S. Bank | $20 to $100 (may be half with qualifying account) |

| Wells Fargo | $20 to $120 (individuals may qualify for free box with qualifying average balance of $5,000) $65 for 3x5, for instance. |

Cash In Safety Deposit Box Rules

NOTE: The banks may offer other sizes. These are just the costs we found for some sizes.

Safe deposit boxes overview

Safe deposit boxes can be found at all major bank branches.

A safe deposit is going to protect your valuables such as jewelry, birth certificates and cash from potential theft, tampering, floods and damage. The boxes will be located at a local bank and will be securely stored in a restricted access area. Depending on the bank, you may be able to access the box with your fingerprint or a key they provide you with. You will only be provided access to your box during bank hours, which are typically nine to five during the week and varying hours on the weekend.

The bank will more than likely assign you a key. While this key won’t necessarily open it, you’re going to need the bank’s key, your signature and even your fingerprint to access your safety deposit box.

What are the extra costs?

Some banks may require a key deposit fee. This is a fee to pay in order to get the key in the beginning, and this deposit fee can be anywhere from $10 to $30.

If you lose the key, many banks are going to charge you to replace the key. This can cost anywhere from $10 to $40+

Drill fees may be required if you lose your key or you need access. These fees can be as much as $150+

Safety Deposit Boxes At Banks

Insurance is highly recommended for items outside of cash. Since the items won’t be covered by the FDIC or the bank, an insurance policy is highly recommended. Plan on paying $15 to $20 per $1,000 worth of valuables.

Tips to know:

It’s always safer to open up a safe deposit safe rather than have a safe at home. While home safes can be cheaper, they are a lot easier to crack if a thief does break into your home.

Safe deposit boxes aren’t covered by the FDIC. If you’re going to keep any type of jewelry or any sort of valuable items, it’s best to have it insured by a separate entity. Talk to your insurance company or broker to see what’s covered.

While it’s safe to keep papers in the box, always make sure that you keep copies at your own home just in case they get lost or something happens.

Attorneys advise you don’t place birth certificates or originals of important documents; instead, consider keeping copies inside. To be extra safe, consider placing these documents in a Ziploc bag. People often include titles, detailed lists of account details, jewelry, stock certificates and family heirlooms.

Finweb.com says you’re able to file this expense on your income tax return if you store your bond or stock certificates.

It’s a good idea to let someone close to you know about this safe deposit box in case something were to happen to you.

Safety Deposit Box Cost A Month

If you don’t pay your box rent, the property will be seized as unclaimed property.

How can I save money?

Consider installing a safety deposit box in your home. ThisOldHouse has a great installation guide on how you can install a safe. Make sure that your safe is bolted into the ground so it can’t easily be taken.

Safety Deposit Box Cost Rbc

If you’re already an existing customer with a bank, they may be able to offer you a discount.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

Average Reported Cost: $0

Regions Safety Deposit Box Cost