Td Savings Account Interest Rate

Get special rates and discounts.

Opening your TD Checking account

is just the beginning – take advantage

of these added relationship benefits.

As a TD personal Checking customer, you get special rates on savings accounts and discounts on home lending solutions. Get the most out of your Checking today.

Get rewarded for building your savings with tiered interest rates. And you can earn an even higher rate by linking your TD personal Checking account to a TD Preferred Savings account.1

TD personal Checking customers receive an extra 0.25% discount off our already low variable rates. Get the most out of your home today.2

At TD Bank, there's always someone to talk to about your account. Call us or come in today.

1-888-751-9000

Live Customer Service 24/7

6% Interest Savings Account

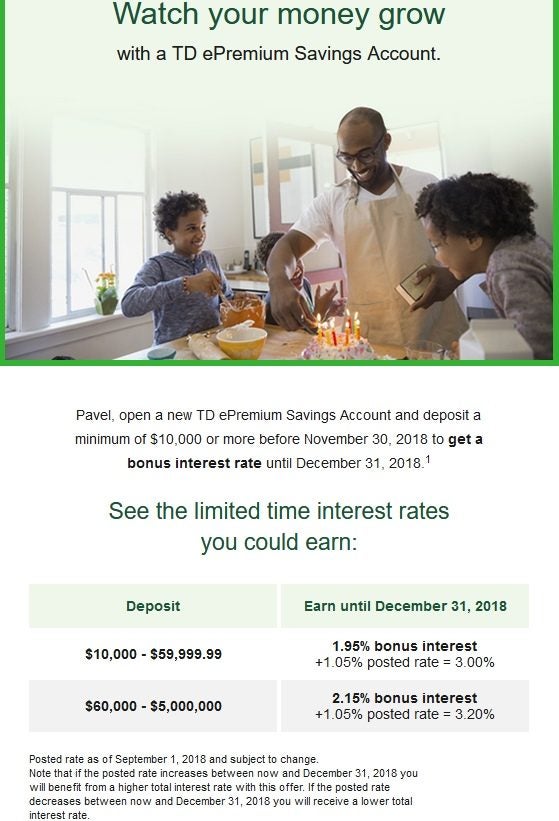

TD ePremium Savings Account Save more with a higher interest rate 1 and free online transfers to your other TD deposit accounts 2. $0 Monthly Fee High interest rate on balances of $10,000 or more. The interest rates are tiered; however, even on the bank’s best rates, you can find higher yields elsewhere. To qualify for the highest rates, you’ll need to have a TD Bank checking account, too. The TD Investment Savings Account is a product for investors seeking flexible fixed income options. Grow your savings in a product that pays a competitive interest rate, and enjoy the security of having your money held in accounts that are.

1Qualifying accounts include TD Bank personal mortgage, home equity, credit card or active personal and business checking accounts. An active checking account must have three customer-initiated deposit, withdrawal, payment or transfer transactions each month to qualify for the rate bump during the following month.

2Available on 1-4 family primary or secondary residences, excluding mobile homes, and homes for sale, under construction or on leased land. A qualifying TD Bank personal checking account is required to be eligible for an additional 0.25% discount. This relationship discount may be terminated and the interest rate on this account may increase by 0.25% upon closure of the qualifying checking account. Rates subject to change.

Loans subject to credit approval.

TD Bank is working to reduce our environmental impact. Find out how

Are you 60 or older?

This is the perfect account for you.

$0 monthly maintenance fee

with $250 minimum daily balance

Earn interest

| Current APY* | Required Minimum Daily Balance To Earn APY* |

|---|---|

| 0.01% | $0.01 |

| *Annual Percentage Yield (APY) is accurate as of 12/22/20 and subject to change after the account is opened. Fees may reduce earnings on the account. | |

Banking that works for you

- Earn interest on your account balance

- Rate discount on TD Bank home loans - .25% off home equity lines of credit1

Extras you'll truly use

- Free money orders

- Free official bank checks

- Free standard checks or discounts on select check styles

- Free paper statements

Save money

- $10 monthly maintenance fee waived when you maintain the $250 minimum daily balance

- Overdraft services available

On-the-go banking

- Free Mobile Banking with Mobile Deposit2

- Online Banking and free Bill Pay with e-bills

- Free online statements with check images

- Live Customer Service 24/7

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

help you over the phone.

Apply in person

1Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

Compare | CheckingSM | |||||

|---|---|---|---|---|---|---|

| Monthly maintenance fee | with a minimum daily balance of $100 —OR— $15 | with a minimum daily balance of $2,500 —OR— $25 | with a $20,000 minimum combined deposit, outstanding loan and/or mortgage balance (excludes credit card) —OR— $25 | with a minimum daily balance of $250 —OR— $10 | ||

| Earns interest | ||||||

| Checks | ||||||

| Online statements | ||||||

| Paper statements | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | (Paper statements are optional for Online Banking customers) | |||

| ATM fees | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | Other banks' ATM fees reimbursed with a minimum daily balance of $2,5001 | ||||

| Overdraft protection | ||||||

| Free with this account | Official bank checks Stop payments Incoming wire transfers | Official bank checks Stop payments Incoming wire transfers No monthly maintenance fee on savings accounts and one additional checking account | Official bank checks |

Free Mobile Banking with Mobile Deposit3

Online Banking and free Bill Pay with e-bills

TD Bank Debit Card available on-the-spot

Live Customer Service 24/7

Free access at thousands of TD ATMs in the U.S. and Canada

Flexible ways to Send Money via text or e-mail and make internal and external transfers3

Free online statements with check images

Rate discounts on TD Bank home loans - .25% off home equity line of credit4

Choice of overdraft services available

Open early. Open late. Most locations open 7 days

Alternate format statements available, learn more about TD Bank accessibility options.

Checkouts just got easier.

Pay with your TD Bank Debit Card

- In person

- Online or over the phone

- In apps or app stores

- Using your digital wallet

Open an account

Apply online

minutes or less.

Call us

help you over the phone.

Td Bank Savings Account Interest Rate

Apply in person

1Non-TD fees reimbursed when minimum daily balance is at least $2,500 in checking account. For non-TD ATM transactions, the institution that owns the terminal (or the network) may assess a fee (surcharge) at the time of your transaction, including balance inquiries.

2TD Bank Mobile Deposit is available to Customers with an active checking, savings or money market account and using a supported, internet-enabled iOS or Android device with a camera. Other restrictions may apply. Please refer to the Mobile Deposit Addendum.

3Send Money is available for most personal checking and money market accounts. External transfer services are available for most personal checking, money market and savings accounts. To use either of these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To perform instant transfers a TD Bank Visa® Debit Card is required. Fees may apply depending on delivery options.

4Loans subject to credit approval. Relationship discount may be terminated and the interest rate may increase upon closure of the qualifying personal checking account.

©2019 Visa U.S.A. Inc.

You might also be interested in:

- TD Debit Card AdvanceSM: a discretionary overdraft service

(Important Information about TD Debit Card Advance)