Time Deposit Account

The BANK may close an account any time without prior notice to the Depositor, if the deposit balance becomes zero, due to collection of service charges by the BANK or withdrawal by the Depositor, or for violation of existing rules and regulations of the BANK, the Bangko Sentral ng Pilipinas, Anti-Money Laundering Council, Bankers' Association. TIME DEPOSIT ACCOUNT A deposit alternative for members whose Capital Contribution Account has already reached the maximum limit. Visit the “Manage Funds” tab within Financial Manager to replenish your deposit account using a one-time electronic funds transfer (EFT) or deposit account transfer. Online replenishments should update your deposit account balance within 15 minutes (it may take longer to appear on Financial Manager reports) and will then be immediately. The interest paid on a time deposit tends to be higher than on an at-call savings account, but tends to be lower than that of riskier products such as stocks or bonds. Some banks offer market-linked time deposit accounts which offer potentially higher returns while guaranteeing principal.

What Is A Current Account?

Time Deposit Accounts Are

A current account is for use by sole proprietors, companies, partnerships, associations, trusts, etc. to make current transactions. All business transactions are conducted through a current account. A current account does not have an end or maturity date.

What Is A Deposit Account/Savings Account?

A savings account is a basic deposit account for an individual to carry out day-to-day transactions and withdrawals. A deposit account can be held individually or jointly by two or more people. A savings account does not have an end or maturity date as well.

Time Deposit Accounts Turkey

Difference Between Current Account And Deposit Account

Some of the differences between a current account and a deposit account are:

- Interest

Interest applies to the minimum balance available in a deposit account. The interest is applicable on the minimum account balance, every day. Banks offer interest rates of 4% or more on savings accounts. Current accounts, on the other hand, are non-interest accounts. There is no interest for any balance in a current account. Although, this may change in the future.

- Transaction rates

Transaction rates apply for withdrawals made over the limit of free withdrawals (usually 3-5) made in deposit accounts. Thus, a savings account holder will have to pay the transaction rate applicable by the bank (eg: INR 20, 25, 50, 90, etc.). Conversely, there are no transaction rates applicable on current accounts. Businesses transact more than individuals and thus, there is no transaction rates or limits on current accounts.

- Minimum balance

Deposit account-holders must maintain a daily average minimum balance in their account. This amount varies from bank to bank and some banks even offer zero-balance deposit/savings accounts. In this case, current account-holders also must maintain a minimum balance in their bank accounts. The minimum balance required for a current account is much higher than the minimum balance required for deposit accounts.

- Overdraft facility

Deposit account-holders can only withdraw what balance is in their saving account. Banks do not offer overdraft facilities on saving accounts unless the customer is a salaried account-holder (approved companies). Whereas, current account-holders can withdraw over and above the balance in an account. Overdraft facilities help businesses to make up cash flows when there is a shortage of funds. Interest is applicable to the overdraft amount taken.

That is the growth you would want to expect from your time deposit.

Time Deposit Account Do Not Earn Interest

Time deposit (TD) is a type of savings account that earns a fixed interest rate upon reaching maturity. Funds in a time deposit cannot be withdrawn during the term of the maturity but can be pre-terminated subject to penalty fees.

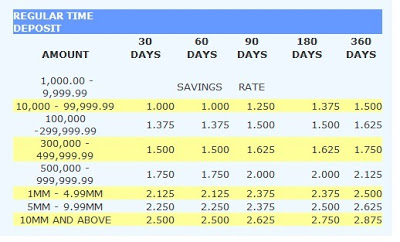

The interest rate in time deposit differs from bank to bank but normally plays between 1.5% and 3% with the latter given to longer term time deposit.

Tenure

The tenure for time deposits usually range from 1 month to 5 years with time deposits with maturity terms below 1 year considered as short term and any deposit with a maturity term exceeding 1 year are long term deposits. Philippine banks normally offers 1%-1.5% for short term TD and up to 3% for long term TDs.

Pre-terminating your Time Deposit

Most time deposits pay out the earned interest only at the end of the term, although some Philippine banks allow you to be paid interest every month in the case of long term deposits. This means, if you chose a one year term deposit, you will earn the entire interest rate as indicated in the agreement you signed at the end of 1 year, provided the principal amount was not withdrawn.

In the event of early withdrawal, the interest is usually forfeited. In other cases, a penalty fee is applied to the depositor, usually equal to up to 75% off of the accrued interest rate from the date of the account creation up to the date of the pre-termination.

If you want to find the best time deposit for your needs, you should check our time deposit comparison table.