Pnc Atm Deposit

- Pnc Deposit Easy Atm Locations

- Pnc Check Deposit Atm

- Pnc Atm Deposit Limit Per Day

- Pnc Atm Deposit Time

- Pnc Atm Deposit Locations

- Pnc Atm Deposit Limit

PNC Bank, for example, accepts cash deposits at non-PNC ATMs, but your funds may not be available for up to four business days. There’s also a chance the ATM operator will charge you a fee for. “If you must use an ATM and it goes awry, note the time of the failed deposit,” says Gilbert, a Los Angeles-based musician who recently tried depositing a check worth about $1,000. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators.

People tend to struggle a lot to find a bank that can allow them cash and deposit their checks at affordable rates. The battle is even tougher for individuals without bank accounts. However, with PNC Bank, these issues have been addressed, purposively to allow all clients to cash their checks in any of their locations across the USA lesser charges.

Contents

- PNC check cashing Policy & Rules

- PNC Bank check cashing fee

Does PNC Bank Cash Checks?

Yes, you can cash your checks at any of PNC Bank branches or ATMs near you today. Also, if you have their mobile app, you can cash your check from home by simply sending the front and back images of your check.

However, if you opt for cashing your check using the app, ensure that you inquire first from the agents if your specific check is acceptable through that format of checking.

Nevertheless, people can cash any of the following checks in PNC Bank:

- Personal checks- Ensure that the details written on the checks match the identification credentials you give. The same applies if you are cashing this kind of checks at any PNC branch or ATM for your friend, relative or any other person.

- Business checks

- Certified checks

- Cashier’s or Treasurer’s checks

- US Treasury checks

N/B: Regardless of the type of check you want to cash at PNC Bank, always carry your identification documents. Also, for PNC account holders, some branches may not ask for IDs, but there are those, which cannot complete your check cashing transactions minus your IDs, irrespective of your customer status at PNC.

PNC check cashing Policy & Rules

All clients at PNC Bank wishing to cash their checks smoothly are requested to read and obey all policies and rules that have been put in place by the bank to guarantee successful completion of these transactions.

Well, as much as all PNC branches share the same policies, there some minor modifications, which you might encounter in some branches.

Therefore, like their esteemed clientele, you are supposed to familiarize yourself with these policies to avoid future problems with the agents when cashing your check (s). The common guidelines and rules that you are most likely to encounter in any PNC branch or ATM that you visit are:

Use of IDs

Always produce a valid ID. Presenting an expired ID will result in automatic termination of the cash checking process. The most preferred IDs in PNC include the State issued IDs, Passport, Military IDs and Driving License.

Important to note is that for non-customers, it is a must that they produce these IDs to be allowed to cash their checks.

Cashing checks for a friend or boss

While this act not allowed in some branches, those that allow you to cash a check for your friend or boss will require that you provide all vitals details, including the contact details. The process of cash checking for a friend will certainly consume more time because of the high rate of verification process that has to be done.

Operating time

Clients are required to be at the bank at least one to the closing time. This applies to those of you who might be wanting to cash your checks during late hours when the branches are almost closing.

PNC Bank check cashing fee

Usually, checks at $24.99 and below are cashed for free. However, if your check is $26.00 and above, but less than $100.00, you will be expected to pay $1.99 as charges for cashing it.

PNC non-customer check cashing fee

Non-customers are those who have not opened an account at PNC Bank but wish to cash their checks here. If you belong to this category, then you will pay 2% of the total amount of your check. However, it is always good that you confirm with your branch as fees may at times differ based on location.

PNC check cashing without Account

The best thing with PNC is that it allows all people, including those without accounts, to cash their checks at their various branches. But for such individuals, they must produce IDs that match the details indicted on their checks.

Again, not all branches or ATMs will allow non-account clients to cash their checks, so if you are one, always inquire from the customer care team first before starting the process.

Pnc Deposit Easy Atm Locations

PNC check cashing ATM

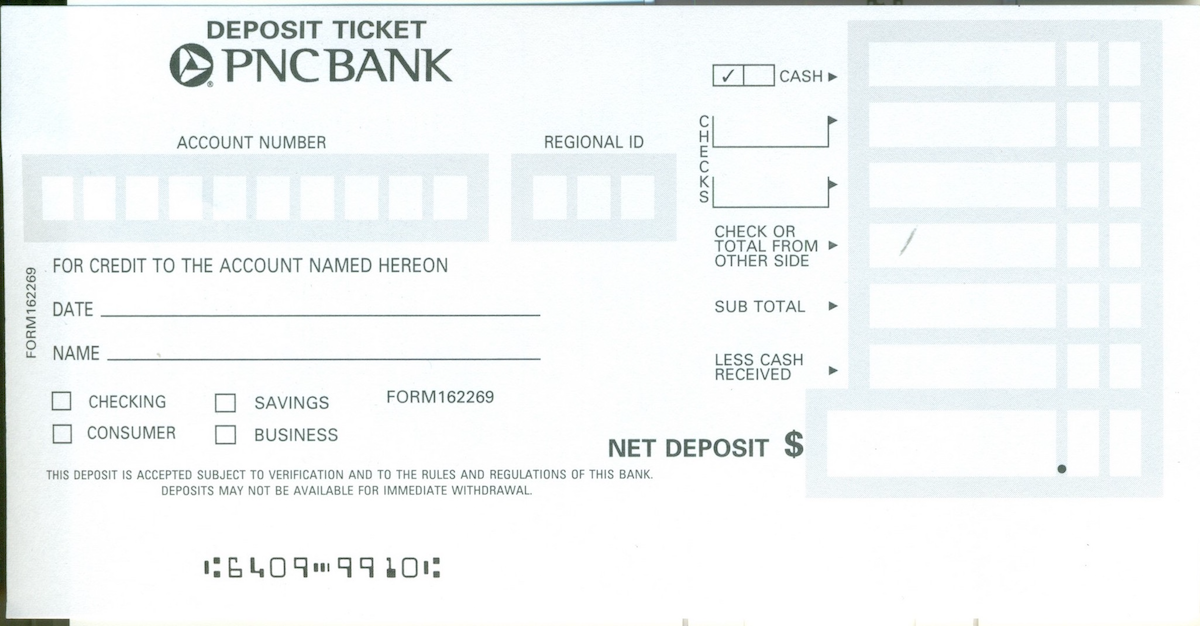

In 2013, PNC upgraded over 3,000 ATMs to allow clients to cash their checks. The best thing with using ATMs is that, for example, if you deposit a check at 9.00 pm, your cash will be available immediately. A transaction at this time is usually considered to have been completed that day.

Other important details about PNC check cashing through ATMs can be read at PRNewsWire.

PNC check cashing App

Deposit your check using your smartphone from your location, securely and conveniently using PNC Mobile Apps for Android and iOS that feature Mobile Deposit.

The process is usually easier, but for you to be able to use the apps, you must register first and be recognized by PNC as an active app user.

In case you find difficulties using the app in cashing your check, contact the 24/7 PNC customer care team, and you will be taken through the procedure.

READ MORE: Fred Meyer check cashing hours

Pnc Check Deposit Atm

Click to see full answer.

Correspondingly, what is a growth account in PNC?

We think it will help you understand your account better and provide insight into procedures at PNC that impact your account. Your Growth account is a savings account which earns interest and can be used for longer-term savings goals. These consumer accounts are for your personal, family or household use only.

Additionally, is PNC Virtual Wallet a checking or savings account? Virtual Wallet is comprised of 3 accounts working together: Your Spend account is a non-interest-bearing checking account. Your Reserve account is an interest-bearing checking account used for short term savings goals.

People also ask, what do you need to open a bank account at PNC?

A. A valid U.S. address and Social Security number are required. You must be 18 years of age or older and will also need to provide a 2nd form of ID.

Pnc Atm Deposit Limit Per Day

How long does it take to transfer money between PNC accounts?

However, international transfers take longer, sent through ACH payments and can cost up to $45 – expensive for a

longer, sent through ACH payments and can cost up to $45 – expensive for a Pnc Atm Deposit Time

money transferPnc Atm Deposit Locations

Pnc Atm Deposit Limit

Details.| Product Name | PNC Bank online money transfers |

|---|---|

| Transfer Speed Minimum transfer time | 3 - 5 days |

| Customer Service | Phone, Email, Branch |